nevada estate tax rate 2021

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Nevada does not collect an estate tax.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Prepared by the Staff of the Local Government Finance Section.

. NRS 3614723 provides a partial abatement of taxes. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Enclosed herewith are the Property Tax Rates for Nevada Local Governments for Fiscal Year 2020-2021.

Do you have an estate plan. 2020 rates included for use while preparing your income tax. In 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or less.

Total US government estimated revenue for 2021 is 768 trillion including 405 trillion federal a guesstimated 214 trillion state and. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Certified by the Nevada Tax Commission.

Compared to the 107 national average that rate is quite low. Carson City NV 89706. The states average effective property tax rate is just 053.

August 25 2021. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent. Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index.

In 2022 Connecticut estate taxes will range from 116 to 12. Tax amount varies by county. Each states tax code is a multifaceted system with many moving parts and Nevada is no exception.

Nevada repealed its estate tax also called a pick-up. It is one of the 38 states that does not apply an estate tax. Home Government Elected Officials County Treasurer Tax Rates.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. Federal Estate Tax Rates for 2022.

31 rows The latest sales tax rates for cities in Nevada NV state. Sales tax still applies in addition to those excise tax rates. 084 of home value.

Nevada State And Local Taxes. Although it did have one prior to the year 2005 it has been phased out. 1550 College Parkway Suite 115.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. Wine is taxed at a rate of 70 cents per gallon beer at a rate of 16 cents per gallon and liquor at a rate of 360 per gallon. Property Tax Rates for Nevada Local Governments FY 2021-2022 Department of Taxation.

Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023. Under Nevada law there are no inheritance or estate taxes.

June 25 2021. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1206 million in 2022 though you will be taxed on the overage not the entire. Rates include state county and city taxes.

But Nevada does have a. The publication has been prepared in five sections noted below. Phone 7756842100 Fax 7756842020.

2020 rates included for use while preparing your income tax. Search This Site Search All Sites Close State of Nevada Department of Taxation. Division of Local Government Services.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. State Agencies State Jobs ADA Assistance.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nevada Tax Rates And Benefits Living In Nevada Saves Money

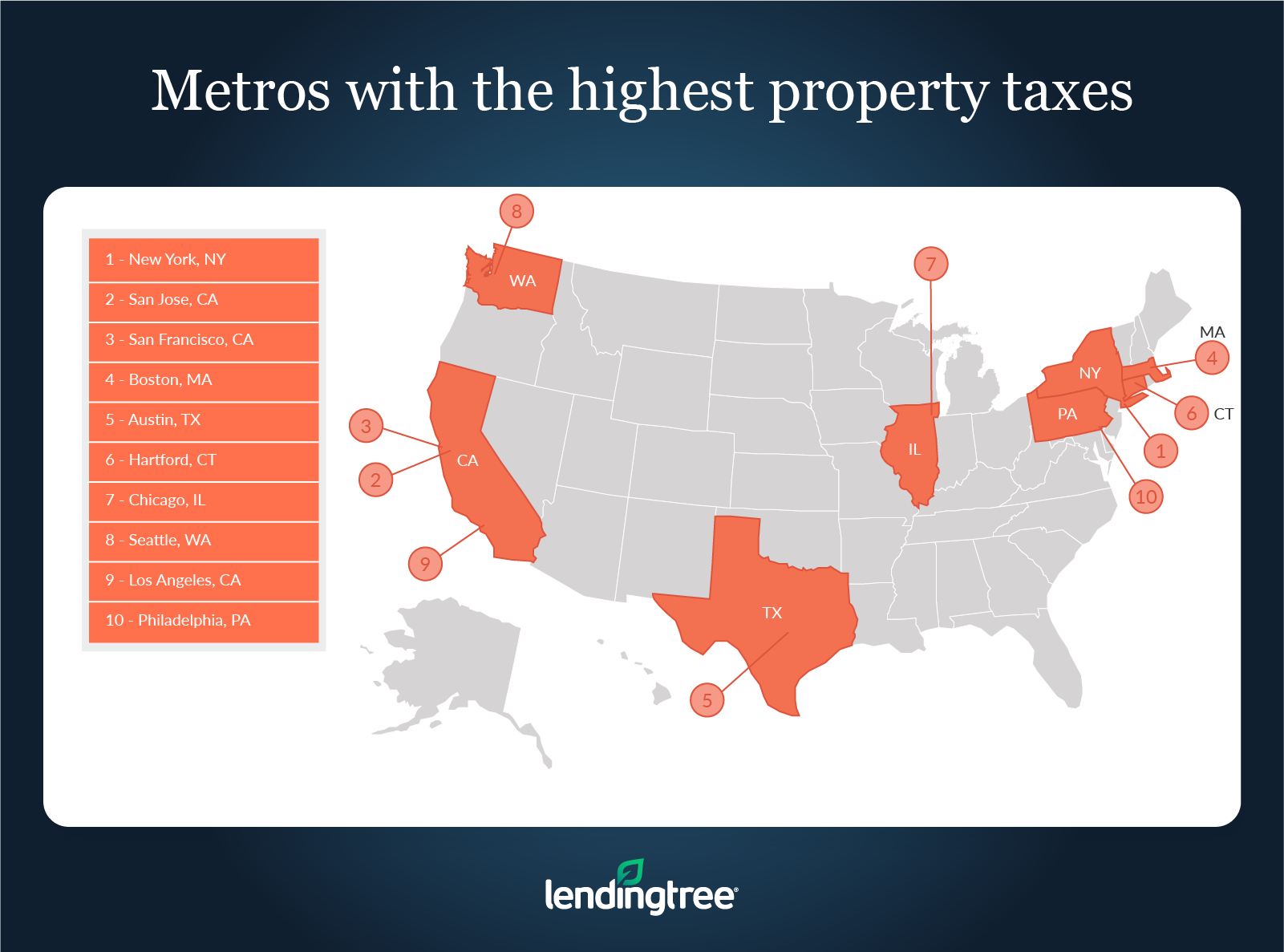

Where People Pay Lowest Highest Property Taxes Lendingtree

Tracking Key Metrics Vital To Growth Key Performance Indicators Metric Lead Generation Real Estate

How And Why To Get Pre Approved For A Mortgage In 2021 Preapproved Mortgage Buying First Home First Home Buyer

State Local Property Tax Collections Per Capita Tax Foundation

Death And Taxes Nebraska S Inheritance Tax

2022 Federal State Payroll Tax Rates For Employers

Where People Pay Lowest Highest Property Taxes Lendingtree

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Income Tax Brackets For 2022 Are Set

Property Taxes On Owner Occupied Housing By State Tax Foundation Infographic Map Real Estate Infographic Map

If You Can T Pay Your Tax Debt In Full Or If Paying It All Will Create A Financial Hardship For You An Offer In Compromis Offer In Compromise Owe Money Offer

Income Tax Brackets For 2022 Are Set

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

If You Can T Pay Your Tax Debt In Full Or If Paying It All Will Create A Financial Hardship For You An Offer In Compromis Offer In Compromise Owe Money Offer